HOW WE HELP

SERVING CUSTOMERS FOR OVER 10 YEARS!

“ Just closed a transaction with The Prospect Group. They were very Kind and Professional! I would love to work with them again:)” – Kathy Gould ![]()

Probates

Probate is a legal process that takes place after someone dies. It includes:

- Proving in court that a deceased person’s will is valid (usually a routine matter)

- Identifying and inventorying the deceased person’s property

- Having the property appraised

- Paying debts and taxes, and

- Distributing the remaining property as the will (or state law, if there’s no will) directs.

Probate usually works like this: After your death, the person you named in your will as an executor — or, if you die without a will, the person appointed by a judge — files papers in the local probate court. The executor proves the validity of your will and presents the court with lists of your property, your debts, and who is to inherit what you’ve left. Then, relatives and creditors are officially notified of your death.

Your executor must find, secure, and manage your assets during the probate process, which commonly takes a few months to a year. Depending on the contents of your will, and on the amount of your debt, the executor may have to decide whether or not to sell your real estate, securities, or other property. For example, if your will makes a number of cash bequests but your estate consists mostly of valuable artwork, your collection might have to be appraised and sold to produce cash. Or, if you have many outstanding debts, your executor might have to sell some of your property to pay them. For example, your house can be sold during the probate process.

Foreclosures

You may even be sitting there and asking yourself, “How are you going to make your next mortgage payment”? If this is the situation you’re going through, it’s important to realize that all is not lost.

Financial troubles can happen to anyone, regardless of education or income. These struggles cause over 500,000 families to lose their home every year. Of course, it’s a difficult process for everyone involved. But it’s unquestionably rough for homeowners who are uncertain how they’ll make their next mortgage payment.

So, what can you do if you’re in a similar position? If you hold a balance on your mortgage loan, then inaction is the sure way to a stressful foreclosure. Fortunately, you have options that allow you to avoid the anxiety that comes with this process. They all work in the event you’re not able or willing to continue paying your mortgage. Here’s what you can do to deal with unmanageable payments or an underwater mortgage. The first two options you have for getting out of a mortgage include waiting for the foreclosure process to finalize or completing a short sale. What’s a foreclosure and how’s it different from a short sale? Let’s cover both options for getting out of your mortgage.

Short Sale

A short sale is different from foreclosure in that in a short sale the homeowner has more control. During the foreclosure process, unless you pay off the mortgage, you don’t have any control of how or when things happen. That’s not entirely the case during a short sale. A short sale occurs when you accept an offer to sell your home for less than the mortgage amount that’s owed. Your lender must also agree to this deal.

Thus, a short sale requires that you work with a real estate agent, your mortgage company, and the third-party buyer. Unfortunately, completing a short sale, or finalizing the foreclosure process both come with major consequences you must understand. Here are the details about these options which may make you think twice.

Benefits of working with a Cash Buyer:

- Avoid credit default

- Allows you to get out of your mortgage a lot easier

- Allows you to gain freedom and presents another chance to succeed

Inherited Homes

Experiencing the loss of a loved one is an incredibly difficult life situation to face. Add that to the challenge of inheriting property and life can quickly become overwhelming. If you need to figure out how to manage your inherited property, it’s best to get advice from those who understand all your options. Let’s discuss the different situations you may face when inheriting a house, and how to make the best choices with your inheritance.

After a loved one passes away and leaves you property, it’s often challenging to decide what to do. One option you have is to live in the home you’ve inherited. But that might not be right for you for a few different reasons.

- Should I Live in Or Rent Out My Inherited Property?

- Should I Sell an Inherited Home?

- If You Want to Sell Your House Fast, You Need to Find Someone You Can Trust. Will I need to pay taxes on the inheritance?

Code Violations

Redeveloping your property is a massive investment of time and money. We work with experienced contractors who redevelop and repair the properties we purchase. Selling a house with code violations is stressful. We buy properties AS-IS, no need to fix your property up to meet code. We help save you time and money as we can make a fast cash offer and close in as little as 7 days.

Don’t allow yourself to feel pressure fixing up your property. Sell to us and we’ll take care of the hard work so you don’t have to!

Benefits of working with a Cash Buyer:

● Avoid paying for costly repairs

● Allows you to get get a fair offer on your property as-is

● Provides you the freedom to sell your property without worry about its condition

Damaged Homes

How to sell a house with damages? Sometimes the unimaginable occurs and we experience fires, earthquakes, vandalism, flooding, or other disasters. Our properties sustain damage, we have to deal with insurance companies, and manage repairs. It can be emotionally and financially devastating to rebuild to get back where we once were.

Prospect Group looks to assist people going through these situations. We work with experienced contractors who redevelop and repair the properties we purchase. We buy properties AS-IS, no need to fix your property! We’ll even let you keep your insurance money so that you can fund the purchase of a new home. We help save you time and money as we can make a fast cash offer and close in as little as 7 days.

Don’t allow these devastating experiences to dictate your future. Sell to us and we’ll take care of the hard work so you don’t have to!

Benefits of working with a Cash Buyer:

● Avoid paying for costly repairs

● Allows you to get get a fair offer on your property as-is

● Provides you the freedom to sell your property without worry about its condition

Problem Tenants

In a perfect world, we have ideal tenants who don’t cause damages, create excessive noise, and/or pay late(or not at all). Unfortunately, it is not uncommon to encounter these problem tenants. Prospect Group purchases any type of Multi-family property regardless of problem tenants. We will purchase Multi-family properties AS-IS! No need to call, email, or confront problem tenants. We make it easy to sell your Multi-family property without having to worry about tenant-related issues. Learn how to sell a property with tenants.

Benefits of working with a Cash Buyer:

● Avoid confronting problem tenants

● Allows you to sell your property without worry

● Gives you the freedom to sell on your terms

Loan Modification

If you are behind on your payment or facing foreclosure, applying for a loan modification places a temporary halt on the foreclosure process.

To simplify it, a mortgage loan modification is any change to the original terms of a loan. Terms may include extending the length of your term, lowering the interest rate, or changing from a variable interest rate to a fixed-rate loan. Ultimately, these changes may results in lower monthly payments for the homeowner.

To service our clients better, Prospect Group has aligned resources, internally, to provide homeowners with options in the event they are facing financial hardship, are behind payments or may be facing foreclosure.

Benefits of working with a Cash Buyer:

● Avoid bad credit and foreclosure

● Provide multiple options to help make more informed decisions

● Supports you in the event you decide to save your home

Liens

A lien is a notice attached to the property telling the public that a creditor claims that the homeowner owes them some money. It is a public record, generally, filed with the county records office (for real property) or with the state agency, such as the secretary of state (for cars, boats, office equipment, and other like items). Although Creditors have the right to have real property sold to pay off the lien, by way of a foreclosure sale, in most cases, Creditors usually wait until the property is sold.

At Prospect Group we don’t shy away from properties with liens. In fact, we work diligently to educate homeowners on how to best navigate this process. For more details read our article on how to sell a house with liens.

Benefits of working with a Cash Buyer:

- Allows you to pay back any owed debt

- Avoid the pre-foreclosure process

- Offers a quick close and allows you to move forward sooner than later

Success Stories

Selling your home doesn’t have to be complicated. We’ve made the process simple

— all it takes is just three easy steps.

Single Family Residence

Single Family Residence

– Out of State Owner

2 Bedroom / 1 Baths; 720 SF

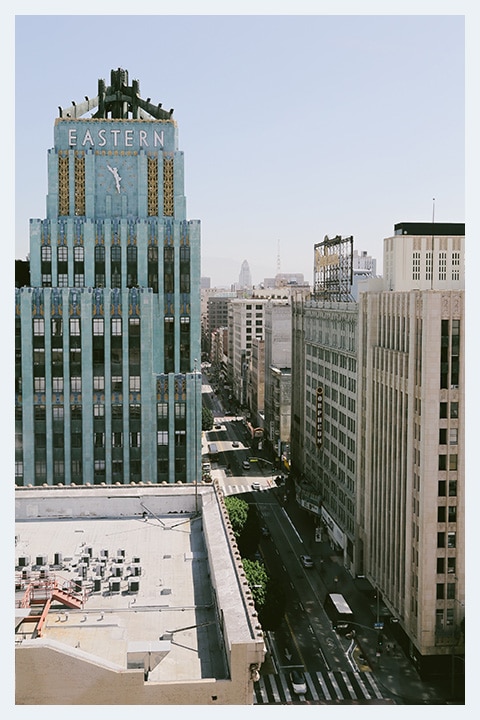

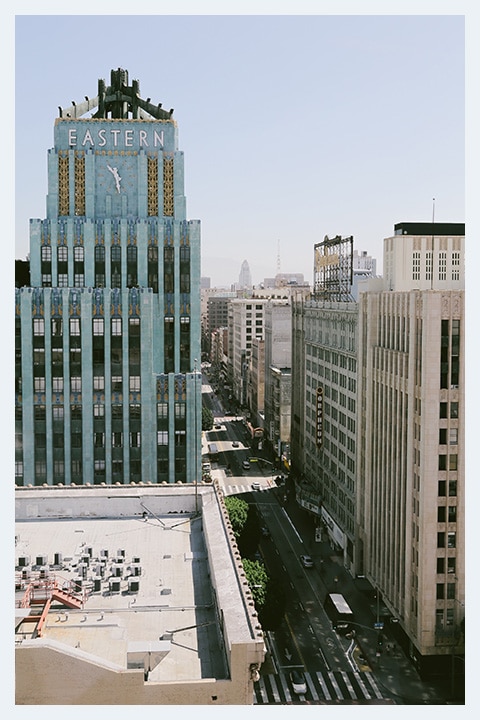

Los Angeles, California

Prospect Group reached out to a homeowner and learned that he was a resident of Nevada and had no interest in selling. His property had been rented and was producing a steady income flow.

Single Family Residence

Single Family Residence

– Liens/Foreclosure

2 Bedroom / 2 Baths; 1,809 SF

Hemet, California

Prospect Group reached out to an elderly couple whose health was deteriorating quickly. They had fallen behind on their mortgage and homeowner association fees. Their home was

Single Family Residence

Single Family Residence

– Foreclosure

2 Bedroom / 2 Baths; 879 SF

Oceanside, California

Prospect Group reached out to an elderly couple who owned a vacation home in a Senior Community Park located in Oceanside, California. The couple were experiencing health issues…

Single Family Residence

Single Family Residence

-Inherited Home

4 Bedroom / 3 Baths; 2,487 SF

Canoga Park, California

Prospect Group reached out to a property owner who recently inherited her childhood property. Unfortunately, she did not have use for the property as it wasn’t located in a nconvenient location.

Single Family Residence

Single Family Residence

– Foreclosure

5 Bedroom / 2 Baths; 1,626 SF

Goleta, California

Prospect Group reached out to a homeowner whose Property was on the fast track of being foreclosed on. The foreclosure date was only 2 weeks away. The homeowner agreed to meet with …

REQUEST A FREE QUOTE TODAY!

FREE No Obligation Offer

Trusted by over 1 MILLION Homeowners

CITIES

Prospect Group Real Estate Investments is a real estate investment and redevelopment

firm specializing in the acquisition of single family homes.

Etiwanda

Fallbrook

Gardena

Glendale

Goleta

Hemet

Highland

Highland Park

Inglewood

Laguna Beach

Long Beach

Los Angeles…

Fallbrook

Gardena

Glendale

Goleta

Hemet

Highland

Highland Park

Inglewood

Laguna Beach

Long Beach

Los Angeles

Manhattan Beach

Marina Del Rey

Menifee

Monrovia

Murrieta

Newbury Park

North Hollywood

Oceanside

Palm Springs

Pasadena

Pomona

Rancho Cucamonga

San Jacinto

Santa Clarita

Santa Monica

Sherman Oaks

Sunland

Tarzana

Thousand Oaks

Torrance

Victorville

Whittier

Winnetka

Woodland Hills

Downey

El Monte

Norwalk

How To Sell Your Property Fast!

Request a FREE Quote

Schedule a Home Visit

Receive a CASH Offer

and Close FAST

WANT A FREE NO OBLIGATION OFFER?